Understanding the Role of Tokenomics in the Success of Cryptocurrencies on Coingi

Understanding the Role of Tokenomics in the Success of Cryptocurrencies on Coingi

What is Tokenomics?

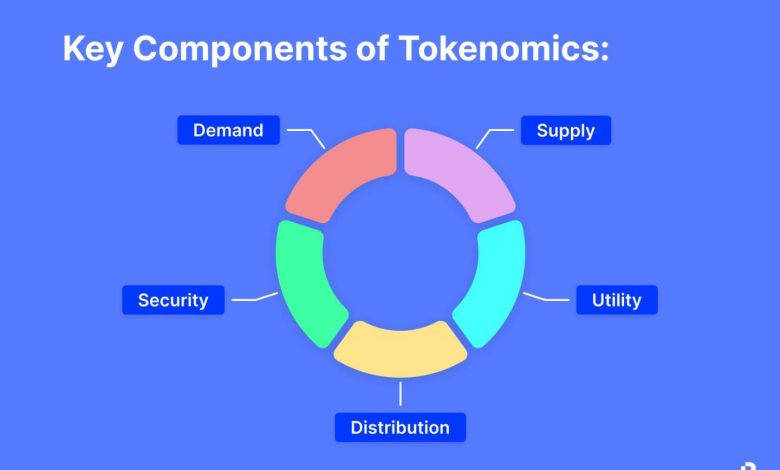

Tokenomics refers to the study of how tokens, the digital assets of cryptocurrencies, work within their respective ecosystems. It encompasses various aspects such as token distribution, utility, governance, and economic models. Tokenomics is crucial in determining the value and success of a cryptocurrency.

The Importance of Tokenomics

Tokenomics plays a vital role in the success of cryptocurrencies on Coingi and other platforms. Here are a few reasons why:

1. Value Creation

Effective tokenomics models create value for token holders. By designing a system that encourages token usage and demand, cryptocurrencies can increase their value over time. This incentivizes users to hold and use the tokens, boosting the overall success of the digital asset.

2. Community Engagement

Tokenomics fosters active participation within the cryptocurrency community. By implementing governance features that empower token holders to vote on important decisions, it encourages involvement and engagement. This democratic approach strengthens the network effect and increases the chances of long-term success.

3. Sustainability

A well-designed tokenomics model ensures the sustainability of a cryptocurrency ecosystem. It aims to create a balance between token supply and demand, preventing inflation or deflation. By implementing mechanisms like token burning, staking, or regular token releases, cryptocurrencies can maintain a stable and sustainable value.

4. Ecosystem Growth

Tokenomics is instrumental in driving ecosystem growth. Cryptocurrencies with well-defined token utility attract developers, businesses, and users to build and participate within the ecosystem. This growth leads to increased adoption and usage, amplifying the success of the cryptocurrency.

Frequently Asked Questions (FAQs)

Q: What is token distribution?

Token distribution refers to the process of allocating tokens within a cryptocurrency ecosystem. It can involve various distribution methods, such as initial coin offerings (ICOs), airdrops, or token sales. Proper token distribution ensures a fair and widespread ownership of tokens, fostering decentralization and community engagement.

Q: Can tokenomics affect the price of a cryptocurrency?

Yes, tokenomics directly affects the price of a cryptocurrency. A well-designed tokenomics model can create scarcity and increased demand, driving the price up. Conversely, a flawed tokenomics model may result in oversupply or lack of utility, negatively impacting the price of the cryptocurrency.

Q: How can token burning benefit a cryptocurrency?

Token burning involves permanently removing a certain number of tokens from circulation. This process can benefit a cryptocurrency by reducing the token supply, thereby increasing scarcity and potentially driving the price up. Additionally, token burning can signal to the market that the project is committed to long-term value creation.

Q: What is token staking?

Token staking is the process of holding and locking up a certain amount of tokens to support the security, governance, or consensus mechanism of a blockchain network. Stakers often participate in block validation, voting, or other network functions and are rewarded with additional tokens for their contribution.

Tokenomics is a critical aspect of the success of cryptocurrencies on platforms like Coingi. By understanding token distribution, value creation, community engagement, sustainability, and ecosystem growth, investors and enthusiasts can make informed decisions in the cryptocurrency market. A solid understanding of tokenomics is key to navigating this exciting and evolving industry.