The Pros and Cons of Using Mobile Money for Remittances

The Pros and Cons of Using Mobile Money for Remittances

Introduction

Remittances, the money sent by individuals to their loved ones in their home country, play a significant role in the global economy. In the past, the process of sending money across borders was often slow and expensive. However, with the advent of mobile money platforms, remittances have become faster and more convenient. In this blog post, we will explore the pros and cons of using mobile money for remittances.

The Pros of Using Mobile Money for Remittances

1. Convenience

One of the biggest advantages of using mobile money for remittances is the convenience it offers. With just a few taps on your smartphone, you can easily send money to your loved ones from anywhere in the world. There is no need to visit a physical money transfer agent or bank, saving you time and effort.

2. Speed

Another significant benefit of mobile money is its speed. Unlike traditional methods of remittance, where it could take several days for the money to reach the recipient, mobile money transfers are almost instantaneous. This is especially crucial in emergencies or urgent situations when your loved ones need the funds immediately.

3. Lower Costs

Compared to traditional remittance methods, mobile money transactions are generally more cost-effective. Instead of paying high fees to money transfer agents or banks, mobile money platforms often charge lower transaction fees. This helps both the sender and the recipient save money.

4. Financial Inclusion

The use of mobile money for remittances has helped promote financial inclusion, especially in developing countries where access to traditional banking services may be limited. Mobile money accounts can be opened easily using a mobile phone, allowing more people to participate in the financial system.

The Cons of Using Mobile Money for Remittances

1. Limited Accessibility

While mobile money has been widely adopted in many countries, there are still regions where it may not be readily available. This can pose a challenge for individuals who want to send or receive money using mobile money but lack access to a reliable network or mobile money agent.

2. Security Concerns

As with any online financial transaction, security is a significant concern when using mobile money. While mobile money platforms strive to implement robust security measures, there is still a risk of scams or hacking. It is crucial for users to be vigilant and take necessary precautions to protect their accounts.

3. Cash Withdrawal Limitations

Some mobile money platforms have limitations on the amount of cash that can be withdrawn per transaction or per day. This can be a drawback if the recipient needs to access a large sum of money quickly. It is essential for users to be aware of these limitations before relying solely on mobile money for remittances.

4. Network Reliability

Mobile money transactions depend on a stable and reliable network connection. In areas with poor network coverage or frequent disruptions, sending money through mobile money may not be a consistent option. This can be a challenge, particularly in remote or rural areas.

Frequently Asked Questions (FAQs)

Q1: Are mobile money transactions secure?

A1: Mobile money platforms prioritize security and employ advanced encryption technologies to protect users’ funds and personal information. However, users should also take precautions, such as keeping their mobile money pin codes confidential and avoiding suspicious links or requests.

Q2: Can I send money to any country using mobile money?

A2: Mobile money platforms have expanded their reach to various countries, but it’s essential to check if the recipient’s country is supported. Some platforms have partnerships with specific countries’ mobile network operators, enabling seamless cross-border transactions.

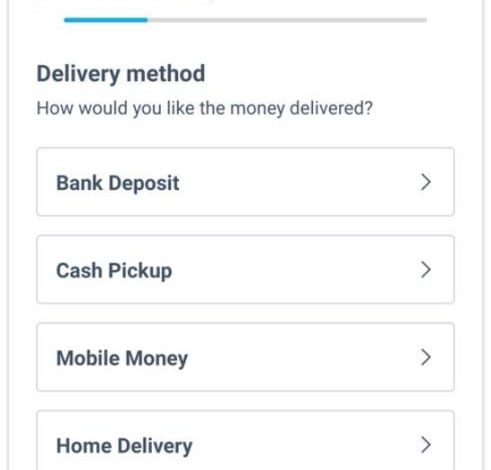

Q3: Can I send money to someone who doesn’t have a mobile money account?

A3: In some cases, mobile money platforms offer the option to send money to non-account holders. The recipient can then collect the funds from a designated agent or convert them into cash. However, this process may involve additional fees or limitations.

Q4: How long does it take for the recipient to receive the money?

A4: With mobile money, the recipient usually receives the funds almost instantly. However, some factors, such as network conditions or the recipient’s mobile money agent availability, may affect the actual time it takes for the money to be accessible to the recipient.

Conclusion

Mobile money has undoubtedly revolutionized the way remittances are sent across borders. Its convenience, speed, lower costs, and contribution to financial inclusion are major advantages. Nevertheless, limited accessibility, security concerns, cash withdrawal limitations, and network reliability remain important factors to consider. Understanding both the pros and cons can help individuals make informed decisions when it comes to using mobile money for remittances.